Market Perspective on All-time Highs, Earnings, and Rates

Join Vector’s Jason Ranallo as we explore stock market highs, robust earnings, and the future of interest rates in our latest podcast episode. Read, watch or listen.

Watch this Episode

This discussion is with Vector advisor and COO Jason Ranallo.

Listen to this Episode

Subscribe to Vector’s Well Balanced podcast on Apple Podcasts or Spotify for weekly market updates and real-world financial planning topics. Including this episode.

Contact Us or Schedule an Intro Call

These discussions aim to spark dialogue about enhancing retirement readiness and making more informed financial decisions. If someone you know is seeking clarity on their financial life, please make an introduction to your team at Vector.

In this week’s Market Perspective we cover three major financial stories making headlines: stock market highs, earnings season highlights, and the outlook for interest rate cuts in 2025.

Key Points:

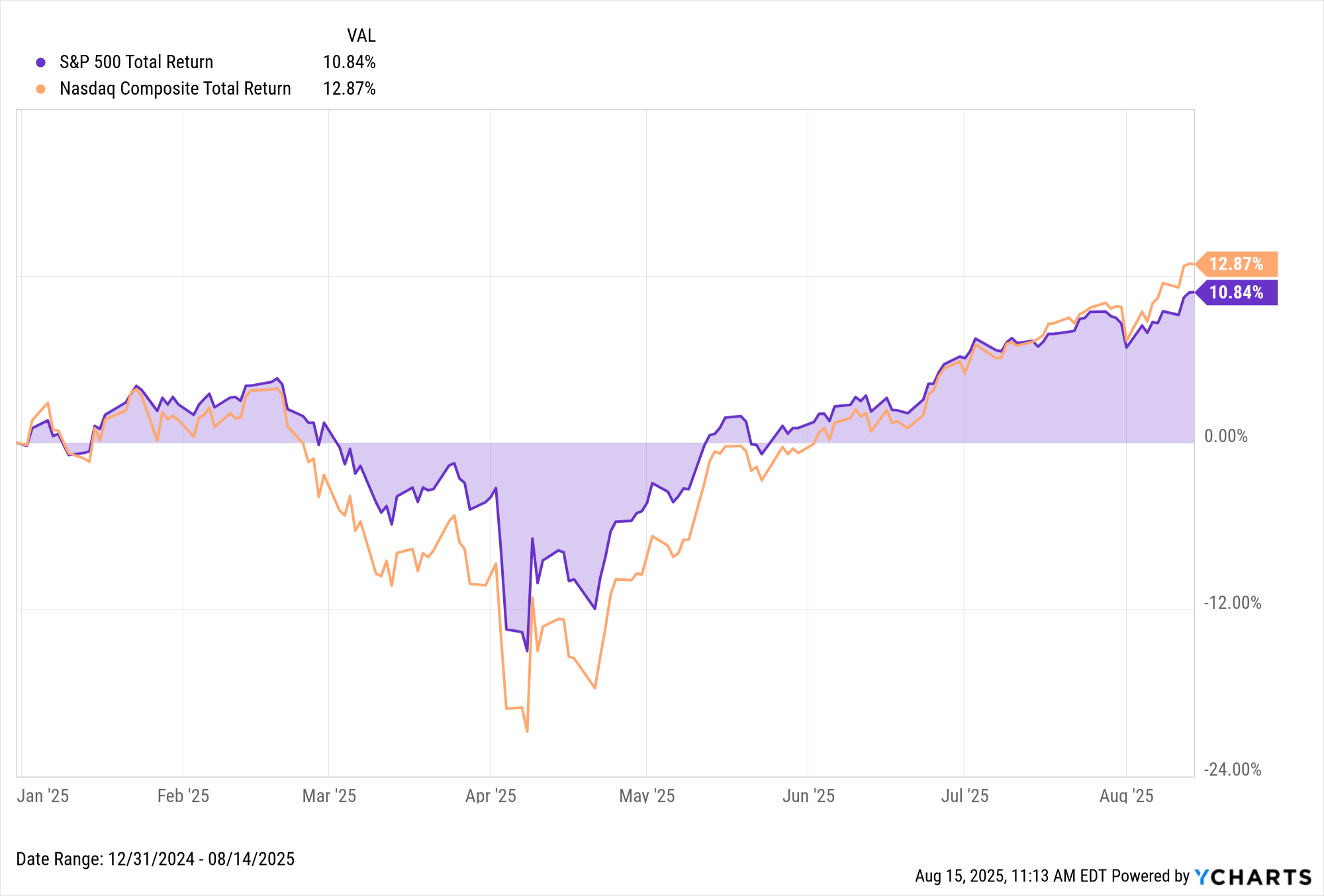

The S&P 500 and NASDAQ reach record highs, driven by optimism over potential interest rate cuts and strong corporate earnings.

AI is transforming from hype to revenue, with significant earnings growth across sectors like technology and financials.

Despite recent PPI reports, interest rate cuts are anticipated in 2025, impacting borrowing costs and investment strategies.

Transcript (adapted for readability)

Hello and welcome back to the Well Balanced podcast from Vector Wealth Management. I'm Jason, and today we'll look at three financial stories making headlines: stock markets hitting fresh all-time highs, stronger than expected earnings, and the outlook for interest rate cuts in 2025. As always, we'll place these topics in the context of what matters most—your long-term financial plan. Here at Vector, we believe in using a bucket-based approach to planning and investing, staging short-term assets for near-term needs while letting long-term investments grow and compound. This framework, we believe, is especially important when headlines feel loud and markets are moving.

Let's get into it. All-time highs.

The S&P 500 and NASDAQ both closed at record highs for the second day in a row this week. That's caught the attention of many investors, fueled by optimism over possible interest rate cuts and a string of strong corporate earnings reports. Historically, when markets hit all-time highs, investors who may try to wait for a pullback often miss more opportunity than they capture. Our approach is to stay invested across multiple time horizons matched to your financial life. We also find there's value in owning a diverse mix of investment assets to help generate returns.

Not all stock market segments are at all-time highs at the same time. And it's worth remembering that all-time highs are not rare events. They're part of a healthy long-term market trend. In fact, over the last several decades, markets have spent a meaningful amount of time in record territory. Reaching a new high often means the market has rewarded investors who weathered through the previous cycles.

Next story, Earning Season Highlights.

The latest Earning Season offered a few interesting themes that go beyond the individual companies reporting. The AI story is now a revenue story. Certain big-name AI-focused companies have shown artificial intelligence is moving from hype to tangible business results. This suggests that AI and ancillary businesses could play a meaningful role in productivity gains and capital investment going forward.

We are just past the peak of Q2 earnings season, and thus far, the S&P 500 index in aggregate is reporting strong earnings results. Both the percentage of companies reporting positive earnings surprises and the magnitude of earnings surprises are above their 10-year averages. Further, nine of the 11 sectors are reporting year-over-year growth in earnings, led by communication services, technology, and financials. In aggregate, corporate earnings grew nearly 12% on a year-over-year basis, which marks the third consecutive quarter of double-digit earnings growth for the index. This has been better than expected.

Moving on to interest rates.

The Producer Price Index or PPI report was released this week, showing that prices surged for producers last month, far outpacing economists' forecasts. These are signs that the cost of tariff-exposed imported goods is increasing. Now, prior to Thursday's report, the market was almost unanimously projecting an interest rate cut in September by the Federal Reserve, a near certainty of a cut in rates. With this new report, the market and, importantly, the Federal Reserve may have had to reassess the timing and the size of any cuts. The thought here is that if inflation remains elevated, then no interest rate cuts.

At this time, based on data we follow, we still expect a cut in 2025. If instead, for example, rates stay unchanged, borrowing costs for households and businesses will remain elevated compared to years past, which can slow certain types of spending and investment. On the other hand, savers will continue to see relatively attractive yields on cash and short-term investments. A rate cut nuance worth mentioning is recessions versus non-recessions. Historically, rate cuts in recession tend to lead to markets down. Cuts outside of recession markets up, at least in the short term. From a long-term perspective, interest rate changes go through cycles. Over time, it's the consistency of planning and investing and letting compounding work that tends to drive outcomes, not the exact timing of rate changes.

In summary,

Markets at all-time highs can be a healthy milestone. Corporate America is showing strength in earnings. Higher than expected producer costs suggest inflation is still a concern. The path to cutting interest rates, if, when, and by how much, feels uncertain as it does inevitable. Zooming out, and we have said this before, markets are unpredictable in the short term, however, trend to the average longer term. Aligning this [zoomed out] framework with portfolios, we believe, allows investors to plan for market declines while participating in long-term growth opportunities.

As always, thank you for tuning in. See you next time.

Regulatory

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies.

Information expressed does not take into account your specific situation or objectives, and is not intended as recommendations appropriate for any individual. Listeners are encouraged to seek advice from a qualified tax, legal, or investment adviser to determine whether any information presented may be suitable for their specific situation.

Investments involve risk and unless otherwise stated, are not guaranteed.

V25226266